The “Impact of Economic Indicators on Investments” holds profound significance for savvy investors. These economic metrics, from GDP growth to inflation rates and employment figures, serve as the North Star guiding investment decisions. Understanding their implications is paramount for those aiming to navigate the complexities of the financial terrain and make informed choices about their portfolios.

Unlocking Economic Insights: The Role of Indicators

Economic indicators are the cornerstone of informed investment decisions, providing crucial insights into a nation’s economic health. Investors rely on these metrics to gauge economic activity, predict inflationary pressures, and lay the groundwork for comprehensive investment analysis.

GDP Growth: A Barometer of Economic Vitality

Gross Domestic Product (GDP) stands as a pivotal economic indicator, symbolizing the total value of goods and services produced within a country. For investors, closely monitoring GDP growth rates is similar to reading the economic weather forecast. A strong GDP signals a healthy economy, influencing investment decisions positively, while sluggish growth may prompt a more cautious approach.

In the complexity of economic indicators, Gross Domestic Product (GDP) emerges as a vital barometer, providing a nuanced glimpse into a nation’s economic vitality. GDP stands as a comprehensive measure, encompassing the total value of goods and services generated within the borders of a country over a specific period. As investors navigate the complex terrain of financial markets, the trajectory of GDP growth becomes a crucial factor in shaping their investment strategies and decisions.

- Understanding GDP Growth: GDP growth serves as an essential lens through which investors can assess the health and vibrancy of an economy. It encapsulates the overarching economic activity, reflecting the combined output of businesses, government spending, consumer expenditures, and net exports. Positive GDP growth is indicative of a flourishing economy, suggesting increased production, rising employment levels, and heightened consumer confidence.

- Investor Confidence and GDP: For investors, GDP growth is more than a statistical figure; it’s a reflection of economic confidence. Robust GDP expansion often translates into a favorable environment for investments. A growing economy tends to foster corporate profitability, positively influencing stock prices. As businesses thrive, they may expand operations, hire more employees, and contribute to a broader economic upswing.

- Impact on Investment Decisions: The rate of GDP growth plays a pivotal role in shaping investment strategies across various asset classes. In equities, for instance, investors may favor sectors that are particularly sensitive to economic expansion, such as technology, consumer discretionary, and industrials. Conversely, during periods of economic contraction, defensive sectors like utilities and healthcare may become more appealing.

- GDP and Fixed-Income Investments: Fixed-income investors also pay close attention to GDP growth as it directly influences interest rates. Central banks frequently modify interest rates in reaction to prevailing economic circumstances. When GDP is robust, central banks may raise interest rates to prevent overheating and inflation. This dynamic interaction between GDP growth and interest rates impacts the performance of bonds and other fixed-income securities.

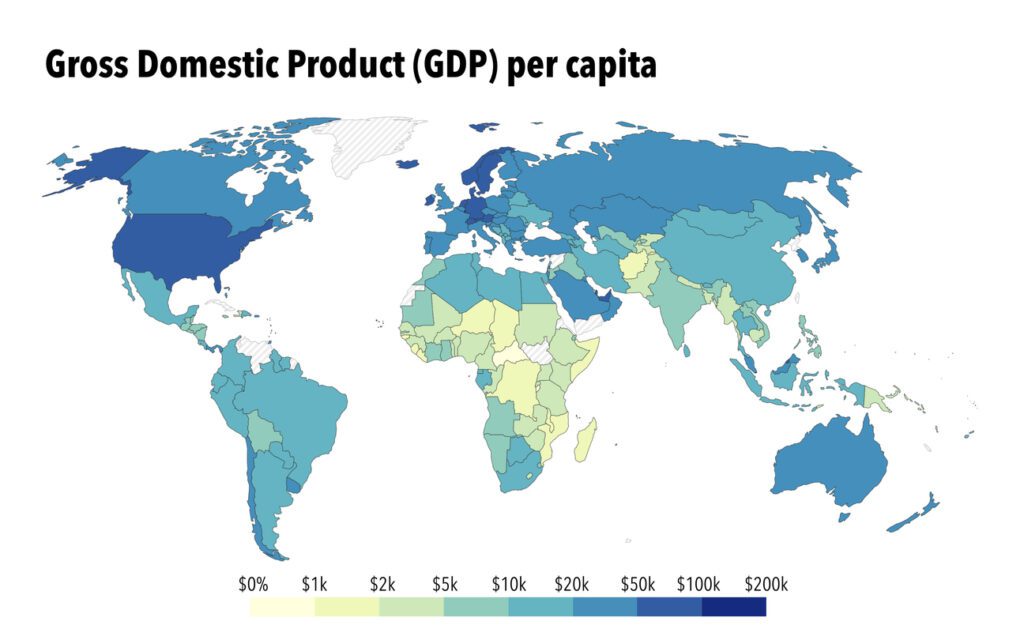

- Global Comparisons and Investment Opportunities: GDP growth is not only a national metric but also a comparative tool for global investors. Analyzing the GDP growth rates across various nations provides insights into relative economic strengths and weaknesses. Investors seeking international diversification can identify opportunities by allocating resources to countries demonstrating robust GDP growth, potentially capturing returns from dynamic and emerging markets.

- Challenges in Interpreting GDP Data: While GDP growth is a powerful indicator, it is not without its challenges. It can mask disparities in wealth distribution, environmental sustainability, and the overall well-being of a population. As such, investors should complement their analysis of GDP growth with a broader understanding of social and environmental factors to make more holistic and responsible investment decisions.

In the ever-evolving landscape of investments, GDP growth remains a central component, offering investors critical insights into economic vitality. As the heartbeat of a nation’s economic health, GDP growth guides investment decisions, influences market sentiment, and shapes the overall landscape of financial markets. Investors who grasp the nuances of GDP growth harness a powerful tool to navigate the complexities of the investment world, aligning their strategies with the pulse of economic prosperity.

Inflation Rates: Navigating Monetary Policy Impact

Inflation rates wield a significant influence on investment strategies. Central banks leverage interest rates to control inflation, prompting investors to adjust their portfolios in response. Understanding the intricacies of monetary policy empowers investors to position themselves advantageously across various market conditions.

Employment Figures: Shaping Consumer Spending

The employment landscape is tightly interwoven with consumer spending, impacting industries from retail to real estate. Investors monitor employment figures keenly to assess potential ripple effects on different sectors, recognizing the intricate relationship between employment rates and consumer behavior.

Interest Rates and Bonds: The Delicate Dance

Interest rates, set by central banks, play a crucial role in shaping investment strategies, especially for bond investors. Careful consideration is essential for understanding the reverse connection between interest rates and bond prices since increasing interest rates can result in declining bond values, directly impacting fixed-income securities.

Global Economic Indicators: Beyond Borders

In our globally interconnected world, economic indicators transcend national boundaries. International investors must monitor indicators from major economies as global trends influence international investments. Understanding global demand, currency values, and geopolitical events is vital for managing diversified portfolios.

Strategic Investments Amid Uncertainty: A Dynamic Approach

In a dynamic economic landscape, investors must adopt a strategic and adaptive approach. Economic uncertainty necessitates diversification, risk management, and staying informed about emerging trends. A comprehensive understanding of economic indicators empowers investors to make well-informed decisions, adapting their portfolios to navigate challenges and capitalize on opportunities.

In conclusion, economic indicators are the compass guiding investors through financial markets. By deciphering the language of GDP growth, inflation rates, employment figures, and more, investors can gain a clearer understanding of the economic landscape. In a world where change is constant, the ability to interpret and respond to economic indicators is a valuable skill for every investor seeking to chart a course to financial success. Now that you understand the different indicators that affect the economy, if you are interested in learning more about investments, Smart Investing from the Start is a great course that provides guidance on which investments are right for you based on your comfort level.